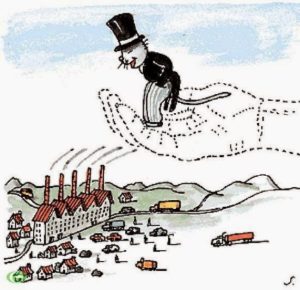

We believe our analysis can strengthen the employment of GVV in three ways: understanding tacit blockages to moral action, i.e., how students’ belief in the moral efficacy of the invisible hand could undermine their own sense of moral duty addressing common rationalizations that may emerge from different assumptions about morally appropriate courses of action in the workplace and resolving values conflicts on how to act. The “Giving Voice to Values” pedagogy aims to enable students to act on their tacit values and address the rationalizations that they may encounter for not acting on these values. ) By revisiting the content of Adam Smith’s “invisible hand” metaphor, we show that the moral content of the metaphor has been significantly misconstrued through its subsequent reception in economic theory. In this paper, we analyze one of the most prevalent metaphors that underpin moral arguments about business, and reveal the beliefs and assumptions that underpin it. If we don’t understand the processes of valuation that underpin our students’ reasoning, our ethics teaching will inevitably miss its mark.

The main contention of this paper is that our ability to embed a consideration of values into business school curricula is hampered by certain normative parameters that our students have when entering the classroom. We conclude by assessing how this approach adds to the existing debate around social responsibility and shared value. Building on his central concept of ‘sympathy’, we introduce the idea of the Impartial Spectator Test, which we argue builds on traditional stakeholder perspectives and which provides an objective route to ethical criteria of demarcation. We identify the eighteenth century economist and philosopher Adam Smith in his book The Theory of Moral Sentiments as a source for an ethical approach to business. ) the problem of the ‘separation thesis’ between business and ethics :89–118, 1996 Harris and Freeman, Bus Ethics Q 18:541–548, 2008). In response to this challenge, we begin by examining Porter and Kramer’s :64–77, 2011) call for a shift from a social responsibility to a shared value framework and the need to respond to (. Today the problem is viewed by many commentators as an ethical challenge to business itself. Growing inequality and its implications for democratic polity suggest that corporate social responsibility has not proved itself in twenty-first century business, largely as it lacks clear criteria of demarcation for businesses to follow. The analytical framework leads to recommendations as to the types of actions that might be more effective in improving business ethical conduct under varying sets of market-based competitive conditions. ) of the interactive effect between different types of external market-based competitive conditions, institutional opportunities to engage in ethical behavior, and the likelihood that corporations would do so. A framework is presented that provides a systematic analysis (.

Therefore, a more comprehensive explanation of ethical business conduct must incorporate both corporate, i.e., internal considerations, and competitive, industry structure-based, i.e., external considerations. This paper argues that in the realworld corporate actions are influenced, to a considerable extent, by external market-based conditions. ( shrink)Īnalysis of ethical conduct of business organizations has hitherto placed primary emphasis on the conduct of that corporation’smanagers because ethical conduct, like all conduct, must manifest itself through individual behavior. It is concluded that ISCT is the most promising normative theory currently under discussion, but that there are some major issues that ISCT has not dealt with yet. Once clarified, this paper applies the framework to the normative versions of stockholder theory, stakeholder theory, and ISCT. It must also outline (6) in what contexts it applies, and (7) what legal and regulatory structures it assumes. It must determine (4) who the normative theory applies to and (5) whose interests need to be considered. It also must specify (3) a decision principle that business people who accept the (. Every normative theory needs to address these seven issues: it needs to specify a moral principle that identifies (1) recommended values and (2) the grounds for accepting those values. This paper proposes a normatively neutral framework for discussing and assessing such normative theories.

This paper carries forward the conceptual clarification of normative theories of business ethics ably begun by Hasnas in the January 1998 issue of BEQ.

0 kommentar(er)

0 kommentar(er)